Choosing the Right Channel Partner for Industrial Exports: A Practical Scorecard

Choosing the Right Channel Partner

Picking the wrong distributor or agent can stall your export growth for years. Use this practical scorecard to evaluate channel partners, validate reach, and structure a low-risk pilot before you commit.

If you export industrial products, your channel partner is part of your product.

They shape how your offer is positioned, how fast you win accounts, how you’re serviced after the sale, and whether your margins survive.

The problem: most “partner evaluations” are based on a nice conversation, a logo list, and optimism. This guide gives you a repeatable scorecard you can use to select better partners — and to avoid expensive, long-term mistakes.

1) First decide what you actually need: agent, distributor, or integrator?

Before you evaluate companies, be clear about the role:

- Sales Agent / Manufacturer’s Rep: sells on commission, you invoice the customer, good for early market entry and control.

- Distributor / Stocking Partner: buys and resells, expects margin + support, ideal when availability/lead time matters.

- Integrator / Solution Partner: bundles your product into projects/systems, best when engineering + installation drives the sale.

Rule of thumb:

If your product is technical and spec-driven → integrator-fit matters.

If availability/lead time wins deals → distributor-fit matters.

If you want fast market learning with lower risk → agent-fit matters.

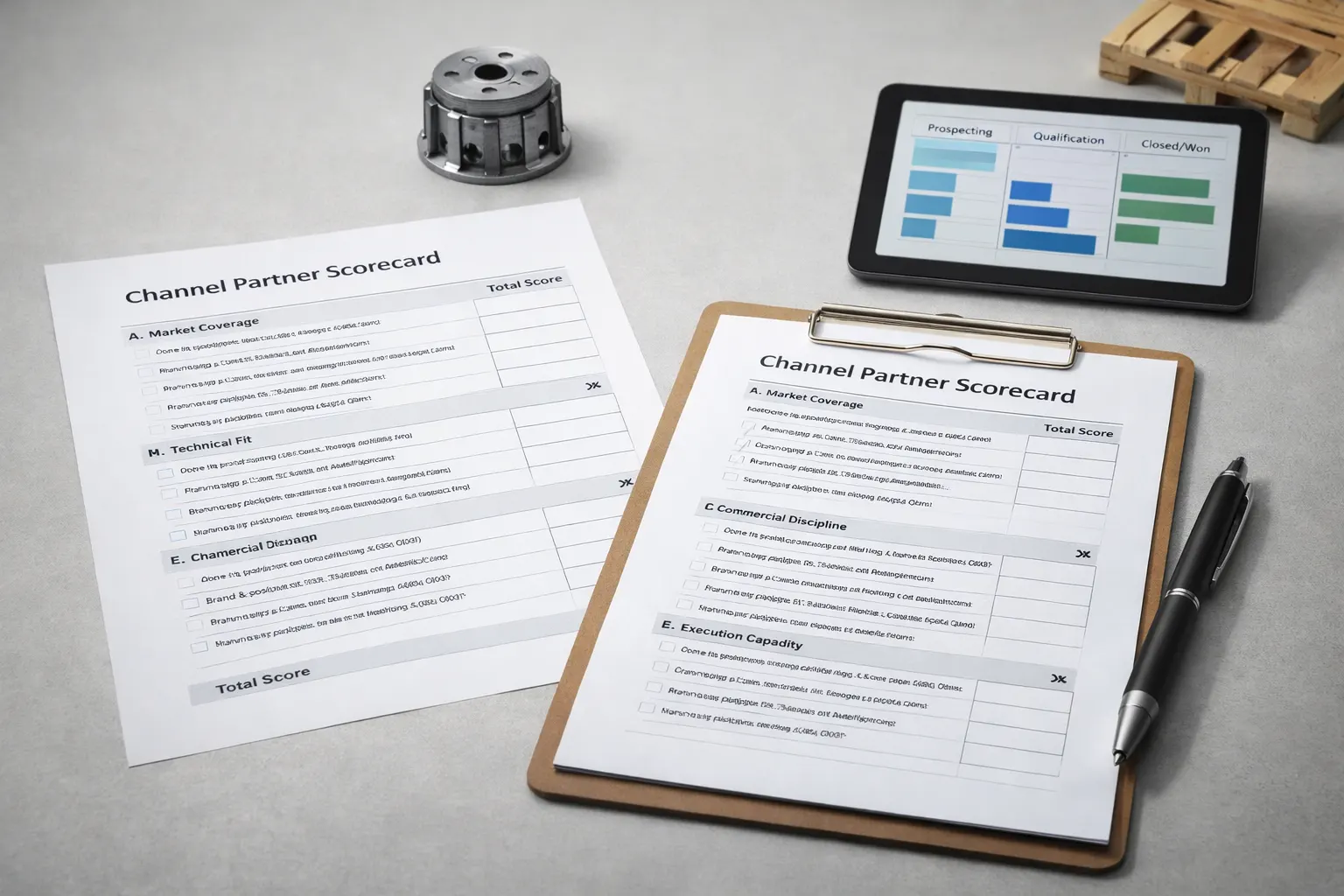

2) The REVROK channel partner scorecard (100 points)

Score each candidate partner out of 100. Aim for 75+ before you invest serious time.

A. Market coverage (25 points)

- Active customers in your target industries

- Geographic reach (real coverage, not “we serve everywhere”)

- Existing relationships with buyers you care about

- Field sales capability vs. inside-only sales

B. Technical fit (20 points)

- Ability to qualify applications (not just forward leads)

- In-house engineering / service resources

- Familiarity with specs, certifications, documentation

- Capability to support commissioning, training, troubleshooting

C. Commercial discipline (20 points)

- Clear pricing/margin expectations

- Clean deal registration rules (prevents channel conflict)

- Forecasting habits and sales process maturity

- Payment behavior (if distributor) or reporting (if agent)

D. Brand & positioning (15 points)

- How they position comparable products

- Whether your product will be “featured” or buried

- Website quality and credibility in your niche

- Trade show presence / industry associations

E. Execution capacity (20 points)

- Speed of response (test them as a “mystery lead”)

- CRM usage and pipeline visibility

- Marketing capacity (email, webinars, campaigns)

- Willingness to run a structured pilot

3) Due diligence: 10 questions you should always ask

- Which 10 customers would you target first — and why?

- What’s your typical sales cycle length in this product category?

- Who handles technical qualification and after-sales support?

- What products do you sell that compete with mine — directly or indirectly?

- What % of revenue comes from your top 5 principals/suppliers?

- How do you handle deal registration and channel conflict?

- What stock do you hold today (if distributor) and what turns do you expect?

- How do you generate demand (marketing activity examples)?

- Who will be accountable day-to-day (names, roles, time commitment)?

- What does success look like in 90 days?

If answers are vague, you’re not getting a partner — you’re getting a brochure.

4) Start with a low-risk pilot (the “90-day proof”)

Instead of signing a long agreement, run a structured pilot:

Pilot scope (typical):

- One region or one vertical market

- A defined target list (e.g., 30–80 accounts)

- Weekly activity reporting (calls, visits, quotes, pipeline)

- Shared messaging + one technical webinar or campaign

- A clear “continue/stop” decision at day 90

What you learn fast:

- Do they actually sell?

- Do they understand your product?

- Do they communicate?

- Do they protect your pricing and positioning?

5) The most common partner mistakes (and how to avoid them)

- Mistake: “They said they can sell it.”

Fix: Ask for a target list + first 10 outreach steps. - Mistake: Signing exclusivity too early.

Fix: Earn exclusivity after performance. - Mistake: No deal registration rules.

Fix: Publish clear rules before the first quote. - Mistake: No onboarding system.

Fix: Provide a simple partner kit (below).

6) Your partner onboarding kit (keep it lean)

Provide these on day 1:

- 1-page product positioning + “where we win”

- Top applications + ideal customer profile

- Technical datasheets, certifications, compliance docs

- Pricing structure + quoting rules

- Lead time and service process

- Objection handling (top 10 objections + responses)

- 3 short case stories (even if small — proof matters)

Call to action (soft)

If you want, REVROK can help you screen partners, structure a 90-day pilot, and build a channel plan that fits industrial products (not consumer-style “growth hacks”). Use the Inquiry/RFQ or Contact form to tell us your product category and target markets.

Latest Posts

- Export Promotion & International Sales for Engineered Industrial Components

- Export Acceleration for US Manufacturers: The 90-Day Channel Launch Plan

- Choosing the Right Channel Partner for Industrial Exports: A Practical Scorecard

- India as a Growth Market for Industrial Suppliers: Export Opportunities and Channel Tips

- Choosing the Right Channel Partner

- Incremental Export: How One Extra Industrial Product Line Can Transform Your Profit

- 輸出加速 – REVROK™ が産業用製品の海外販売を伸ばす方法

- 加速出口 —— REVROK™ 如何帮助工业制造商开拓国际市场